Ensure Your Business’s Success by Common-Sizing Quarterly Financials

As a business owner, understanding the financial health of your enterprise is critical for making informed decisions and planning future strategies. One effective method to achieve this is by "common-sizing" your financial statements quarterly. This practice converts your financial data into percentages, allowing you to easily compare performance over different periods and against industry benchmarks. Not only does this help in maintaining a healthy business, but it also makes it attractive to potential buyers when the time comes to sell.

Key Takeaways

- Common-size financial statements help track business health and performance.

- Regular review and documentation of financials are essential for strategic decision-making.

- Common-size statements make your business more attractive to potential buyers.

- This practice simplifies comparisons across different time periods and with other businesses.

- Proper financial tracking can prevent red flags for potential buyers.

The Importance of Tracking Financial Health

Every business owner needs to know how their business is performing, not just at year-end but throughout the year. By regularly reviewing common-size financial statements, you can gain a clear understanding of your business’s health. This process involves converting each line item on your financial statements into a percentage of a base figure (total assets for the balance sheet, and total sales for the income statement). This allows for easy comparison across different time periods and helps identify trends and anomalies.

Real-life Scenario

Consider a small retail business owner who reviews their common-sized financial statements quarterly. They notice a steady increase in their

cost of goods sold (COGS) over three quarters, but their sales have remained relatively flat. This trend prompts them to investigate further and discover that their supplier prices have increased. With this information, they can negotiate better rates or find alternative suppliers, ultimately improving their gross profit margins.

Practical Steps to Common-Size Your Financials

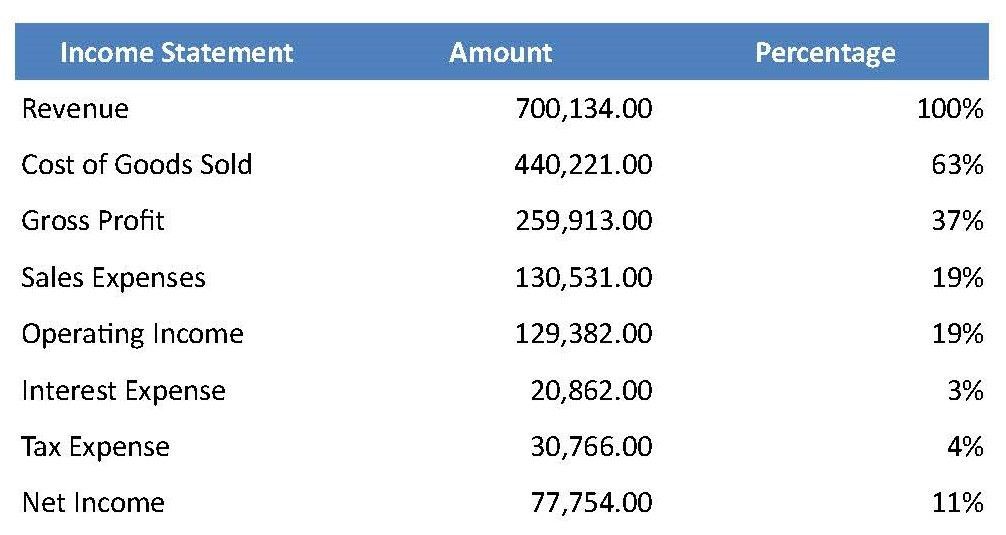

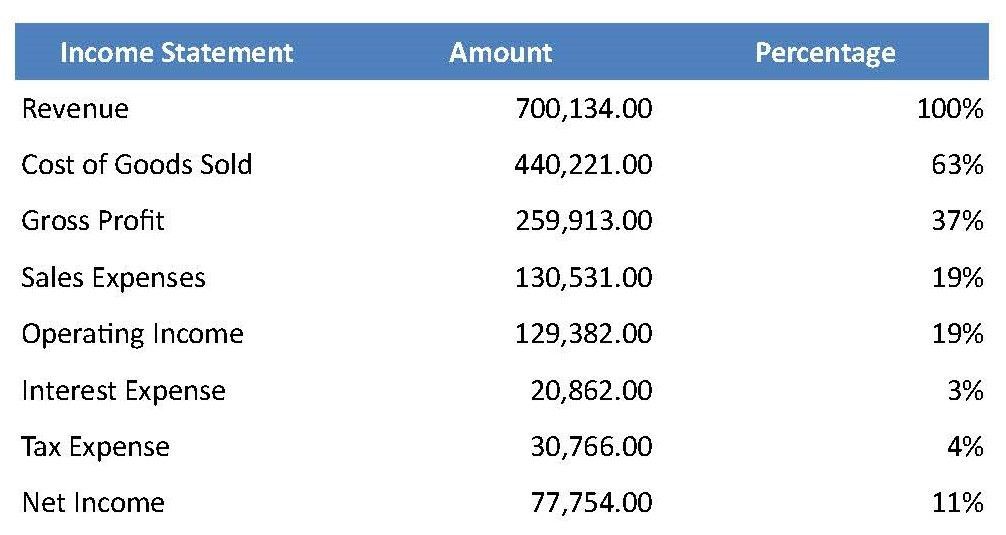

To common-size your financial statements, start by examining your balance sheet. Convert each asset, liability, and equity item into a percentage of the total assets and total liabilities plus equity, respectively. For the income statement, express each line item as a percentage of total sales. Here’s how it can be done:

Common Size Income Statement

Common Size Balance Sheet

Benefits of Regular Financial Review

Regularly reviewing your financials and documenting any significant changes can help you make informed decisions. For instance, if you notice a sudden increase in operating expenses, you can investigate and address the cause promptly. This proactive approach ensures the smooth running of your business and provides a solid track record that reassures potential buyers of your business’s stability and profitability.

Practical Tip

Set a recurring reminder on your calendar to review your financials at the end of each quarter. Dedicate a specific day to go through your common-size statements, compare them with previous periods, and document any significant changes or trends you observe.

Preparing for Future Sale

When it comes time to sell your business, having well-documented, common-size financial statements can make a significant difference. Buyers are looking for profitable businesses with clear, understandable financial histories. By providing common-size financials, you offer transparency and demonstrate that you have been diligently managing your business’s financial health. This can make your business more appealing compared to others that lack such detailed financial tracking.

Example

Imagine a potential buyer comparing two similar businesses. One has detailed, common-size financial statements showing consistent growth and well-documented explanations for any variances. The other has only basic financial reports with no clear trends or explanations. The buyer is likely to favor the first business, perceiving it as better managed and less risky.

Wrap-Up

Regularly common-sizing your quarterly financials is a powerful tool for tracking your business’s health and preparing for future opportunities. It allows for clear comparisons, aids in strategic decision-making, and enhances the attractiveness of your business to potential buyers. Start implementing this practice today to ensure your business’s ongoing success and appeal.

FAQ

What is common-sizing in financial statements?

Common-sizing involves converting each line item on your financial statements into a percentage of a base figure (total assets for the balance sheet, and total sales for the income statement). This allows for easy comparison across different time periods and with other businesses.

Why is common-sizing important for my business?

Common-sizing helps you track your business’s health, identify trends and anomalies, and make informed decisions. It also enhances the attractiveness of your business to potential buyers by providing clear, understandable financial histories.

How often should I common-size my financial statements?

It is recommended to common-size your financial statements quarterly. Regular reviews help in maintaining a healthy business, making strategic decisions, and preparing for future sale opportunities.

Get in Touch:

First Choice Business Brokerage Phoenix

📍 21640 N 19th Ave Suite C9, Phoenix, AZ 85027

📞 (623) 888-6190

Recent articles for you