Understanding Working Capital Adjustments in M&A Deals (2025 Update)

What Is Working Capital, and Why Should You Care?

When selling or buying a business in the U.S., one financial term often causes confusion and frustration: working capital adjustment. It sounds technical, but it’s actually a very practical concept—especially when you're about to exchange hundreds of thousands (or even millions) of dollars.

So, what is working capital? In simple terms, it's the money a business needs to keep operating every day. That includes paying bills, buying inventory, and handling short-term expenses.

Here’s a basic formula:

Working Capital = Current Assets – Current Liabilities

Let’s use a real-world example. Imagine you own a small bakery:

- You have $50,000 in cash, $20,000 in flour, sugar, and inventory, and $15,000 customers owe you. That’s $85,000 in current assets.

- On the other hand, you owe $25,000 to suppliers and $10,000 in employee wages. That’s $35,000 in liabilities.

So, your working capital is $85,000 - $35,000 = $50,000.

This $50,000 is the fuel that keeps your business running. And when you sell the bakery, the buyer expects that same fuel to be included—unless you agree otherwise.

What Is a Working Capital Adjustment in M&A?

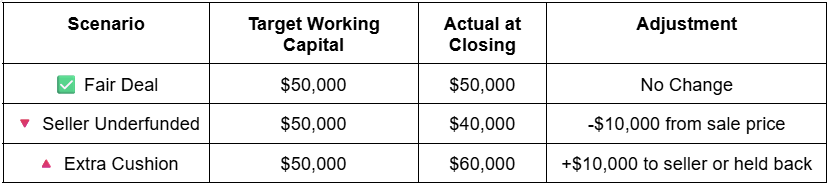

When selling a business, both buyer and seller agree on a target working capital amount. This is what’s needed to keep the business running normally after the sale.

If, on closing day, the business has less than the agreed amount, the buyer gets a price reduction. If it has more, the seller may get a bonus.

Think of it like buying a car. If you agree to buy it with a full gas tank but show up and it’s empty, you’d either want the tank filled or the price adjusted.

Same idea with a business.

Why Buyers Care About Working Capital

Buyers don’t want to invest in a company and then immediately have to inject more cash just to pay vendors, rent, or salaries.

They want to buy a fully operational machine, not one running on empty.

That’s why working capital adjustments are written into most U.S. business purchase agreements—especially deals above $500,000.

How Working Capital Adjustments Affect the Purchase Price

Here’s how it works:

- Both parties agree on a "target" working capital, usually based on a 6–12-month average.

- On closing day, the actual working capital is measured.

- If the actual number is lower, the price is adjusted downward.

- If it’s higher, the seller gets a bonus or retains the excess.

This is why working capital can significantly impact your final payout.

The Business Broker’s Role in This Process

A skilled business broker helps sellers:

- Set the right expectations around working capital

- Avoid pricing surprises

- Negotiate fair terms with buyers and their advisors

Take this real-life example: One seller listed their logistics business for $2.4M. But during due diligence, the buyer’s CPA flagged $80K of unpaid vendor bills. The working capital adjustment could’ve cost the seller over $100K. Luckily, with help from the broker, both parties agreed on a revised peg and kept the deal alive.

How to Set the Right Target Working Capital

Most buyers and sellers agree on a 12-month average of working capital to smooth out seasonal fluctuations. But that’s not always enough.

For example:

- Retailers may have higher working capital before the holidays

- Service businesses may show spikes in receivables at the end of a quarter

- Manufacturers hold inventory for longer cycles

So, your broker and CPA should review:

- Industry trends

- Seasonality

- Your specific operating cycle

- One-time events (e.g., COVID relief grants)

Working Capital vs. Business Valuation: Are They Connected?

Yes—and no.

Technically, working capital isn’t part of your valuation (like EBITDA or SDE), but it affects the cash flow a buyer inherits. If your business routinely runs tight or late on bills, it looks riskier.

In contrast, strong working capital shows buyers:

- You manage money well

- You’re unlikely to face cash flow issues

- They can jump in with confidence

Let’s Talk “Pegs” (Not the Pirate Kind)

A working capital peg is the agreed number the buyer and seller use as a baseline.

For example, if both sides agree that the business needs $75,000 to operate smoothly, that becomes the peg.

If, at closing, the working capital is only $65,000, then $10,000 is deducted from the price. It works both ways.

Tips:

- Don’t set the peg too high to “look strong.” It could backfire.

- Use accurate, clean financial data (no last-minute “fluff”).

- Get guidance from your broker and CPA early.

Post-Close True-Up and Escrows: What Happens After the Sale?

Most U.S. M&A deals include a “true-up” period—typically 30 to 90 days after closing. This allows time for both sides to review final numbers and reconcile differences.

If working capital comes in below the estimate, the buyer can:

- Deduct the difference from the

escrow (money held back at closing)

- Request a refund or negotiate a final adjustment

That’s why working capital adjustments aren’t just theoretical—they can affect how much money changes hands even after the deal is signed.

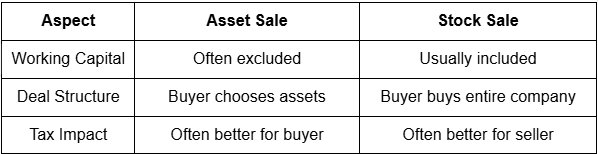

Asset Sale vs. Stock Sale: What’s the Difference?

Working capital adjustments are more common in

stock sales, but can apply in either structure.

U.S. Market Conditions in 2025: Why This Matters Now

In today’s market:

- Interest rates are still relatively high

- Buyers are more cautious

- Cash-heavy businesses are more attractive

That means your working capital practices (and documentation) are more important than ever. Buyers want assurance that your business won’t drain their resources right after the sale.

Preparing for Working Capital Adjustments: A Seller’s Checklist

Before listing your business, do the following:

- Clean up accounts payable and receivable

- Get an accurate inventory valuation

- Remove one-time windfalls or write-offs

- Prepare 12-month average reports

- Ask your broker to review the target peg

Final Thoughts

Don’t Let Working Capital Ruin a Great Deal

Understanding working capital adjustments might sound like a dry accounting topic, but it’s a key part of protecting your sale price.

Handled right, these adjustments help build trust, reduce last-minute surprises, and lead to a smoother closing.

Whether you’re buying a business in the U.S. or planning how to sell a business, having a professional guide by your side makes all the difference.

Let’s Talk — We’ll Guide You Through It

Thinking of selling? Not sure how working capital affects your deal?

Our expert brokers at First Choice Business Brokers Phoenix Northwest are here to help. We’ve guided hundreds of deals across the U.S., and we’re ready to do the same for you.

Let’s make your business sale a success.

FAQ

1. Do all business sales include working capital adjustments?

Not all. But they’re very common in deals above $500,000 or businesses with significant inventory or receivables.

2. Who decides the working capital target?

It’s negotiated between the buyer and seller—usually with help from brokers, CPAs, and attorneys.

3. Can working capital be negative?

Yes. If liabilities exceed current assets, working capital is negative. This can scare off buyers or reduce your valuation.

4. What’s excluded from working capital?

Typically: cash, long-term debt, and taxes payable. But always confirm what's included in your deal.

5. What happens if we disagree on the adjustment?

Most agreements include a dispute resolution clause—usually involving third-party review or mediation.

6. How do I avoid surprises at closing?

Work with a business broker early. Get clean financials. Don’t “guesstimate” your numbers.

Get in Touch:

First Choice Business Brokerage Phoenix

📍 21640 N 19th Ave Suite C9, Phoenix, AZ 85027

📞 (623) 888-6190

Recent articles for you