2024 Q3 Dealmaking Surges as Buyers Pay Premiums for Retail & Services

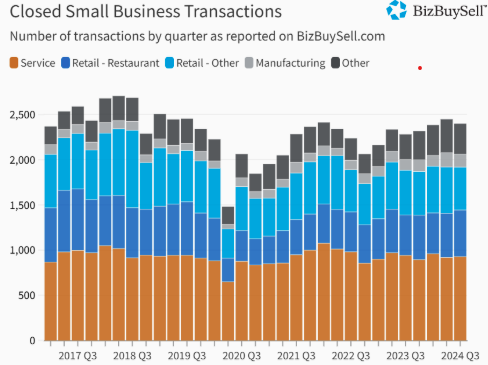

The U.S. small business acquisition market has seen notable growth as buyers increasingly seek opportunities despite elevated financing costs. In the third quarter of 2023, dealmaking activity grew 5% year-over-year, marking the fifth consecutive quarter of gains. However, transactions did dip slightly by 2% from the previous quarter, with both buyers and sellers exercising caution amid upcoming election dynamics and anticipated rate adjustments. Here’s a breakdown of what’s driving these trends and how key sectors are performing.

Q3 Dealmaking by the Numbers

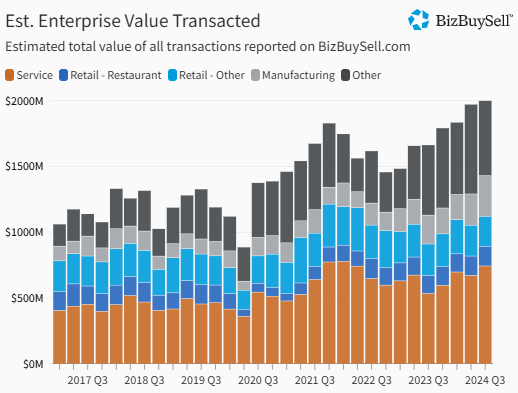

According to data from BizBuySell, Q3 saw 2,399 business acquisitions, representing a total enterprise value of $2 billion—20% higher than Q3 2022. Leading the charge were service businesses (39%), followed by restaurants (21%), retail (20%), and manufacturing businesses (6%). These figures underscore buyers’ commitment to securing high-potential assets, even as the market faces rising interest rates and evolving financial landscapes.

Service businesses have seen a 16% increase in median sale prices, and retail businesses a notable 11% rise. This willingness to pay premium prices reflects buyers’ heightened focus on cash flow and revenue performance, especially in sectors like delivery routes and automotive repair within services and high-sales retail establishments.

Financial Performance and Pricing Trends

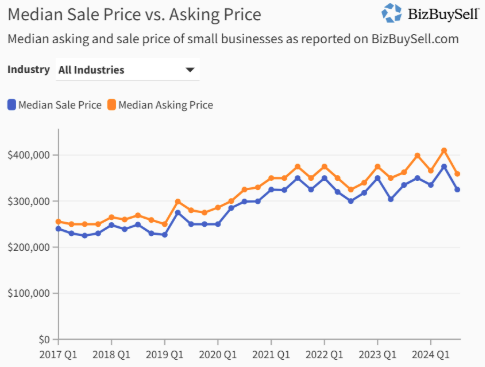

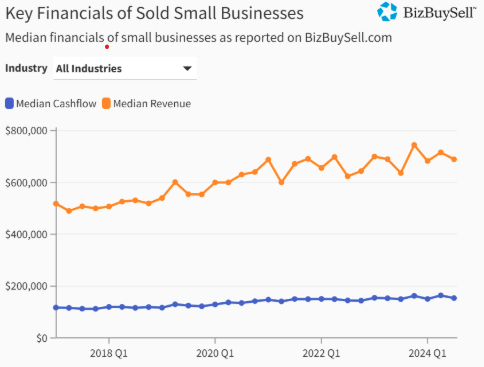

While the median revenue for businesses sold in Q3 is up 8% from the previous year and cash flow has increased by 3.5%, median sale prices dropped 13% from the previous quarter. This decline reflects a shift in buyer and seller expectations, with many transactions incorporating creative deal structures, such as seller financing, to bridge valuation gaps and mitigate the effects of higher interest rates.

- Service Sector: Dominating sales, service businesses maintained strong growth with a median revenue increase of 18% and a 21% cash flow increase. The diversity of service businesses, especially in delivery and automotive repair, has kept them attractive to buyers, who are willing to pay higher prices for assets with solid performance.

- Retail Sector: Despite a 4% decrease in transaction volume from last year, retail businesses have enjoyed a median sale price jump of 11%, with revenue up 18%. Buyers are particularly drawn to retail businesses with robust sales volumes, even as these businesses report a slight 2% decrease in cash flow margins.

Restaurant and Manufacturing Sectors Hold Steady

The restaurant sector experienced a 15% year-over-year increase in acquisitions in Q3. Although median sale prices have remained stable, revenues have decreased by 7%, and cash flow is flat—reflecting the industry's ongoing challenges with rising overhead costs in food and labor. Despite this, the demand for restaurant businesses has remained robust, with days on market decreasing as these establishments are being sold faster.

Manufacturing businesses, although a smaller portion of total transactions, have also seen strong demand, with transactions up 20% year-over-year. While sale prices and revenue growth have remained flat, these businesses continue to draw buyers, particularly in sectors like food manufacturing, printing, and signage. This interest stems from a reliable performance in a market where tangible goods production continues to hold intrinsic value for buyers.

Increased Seller Financing and Creative Deal Structures

With interest rates affecting acquisition costs, a notable trend is the rise in seller financing options. According to BizBuySell’s survey, 28% of sellers are now open to offering financing, up from 24% in 2023 and 21% in 2022. The shift allows buyers to bypass restrictive lending rates and pursue purchases with more favorable, seller-driven terms.

Katrina Loftin, managing partner at M&A Business Advisors, notes the emergence of creative financing as a motivator in deal closures: “We’ve observed a 10% reduction in asking prices in some cases, with more buyers seeking seller financing below SBA rates.” Sellers are becoming more adaptable to ensure transactions proceed, especially with some banks offering incentives that keep buyer interest high.

Market Resilience Amid Rate Fluctuations

Though interest rates remain high, recent cuts have had limited impact on buyer and seller timelines. In fact, 70% of owners report that rate cuts have had no effect on their plans, while 64% of buyers express the same sentiment. This stability is fueled by both parties’ resolve to reach agreements based on solid financials, rather than waiting for uncertain market shifts.

According to John English, an M&A advisor in Texas, the market is less impacted by purchase price than by debt servicing capabilities, creating space for inventive deal structures that can neutralize external rate pressures. This dynamic, he says, “makes us somewhat immune to other market forces,” highlighting the resilience of today’s small business acquisition market in the face of economic headwinds.

Key Takeaways for Buyers and Sellers

As Q4 unfolds, both buyers and sellers in the small business market are expected to remain active, balancing the ongoing effects of interest rates with sector-specific performance metrics. For prospective buyers, focusing on service, retail, and manufacturing sectors with proven cash flow potential and flexibility in financing terms will be key. Meanwhile, sellers who are open to innovative deal structures and realistic pricing stand to benefit from today’s active market.

The combination of rising transaction volumes, sector-specific performance, and increased reliance on seller financing illustrates a vibrant marketplace where both sellers and buyers can find favorable opportunities. Whether or not the upcoming election or further rate changes will significantly impact this trajectory remains uncertain, but the market’s resilience thus far bodes well for continued growth in small business acquisitions.

Source: BizBuySell Insight Report

Contact Us

First Choice Business Brokerage Phoenix

📍 21640 N 19th Ave Suite C9, Phoenix, AZ 85027

📞 (623) 888-6190